The current dividend yield of the S&P 500 index is 1.79%. Because of this paltry current yield, it is very hard to imagine the broad index such as S&P 500 as an income producing investment. But, if you take a closer look at the numbers then you can see that common stocks can provide amazing returns through the dividend.

In the table below I display the dividends paid out by S&P index from year 1988 to 2004. On 12/31/1988 the S&P 500 index closed at 277.78. The total dividend payout in dollar terms was $9.73 to investors. Hence, the dividend yield was 3.50% at the end of 1988.

| Year | S&P 500 Cash Dividend | S&P 500 Dividend Yield |

| 1988 | $9.73 | 3.50% |

| 1989 | $11.05 | 3.97% |

| 1990 | $12.09 | 4.35% |

| 1991 | $12.20 | 4.39% |

| 1992 | $12.38 | 4.45% |

| 1993 | $12.58 | 4.52% |

| 1994 | $13.18 | 4.74% |

| 1995 | $13.79 | 4.96% |

| 1996 | $14.90 | 5.36% |

| 1997 | $15.49 | 5.57% |

| 1998 | $16.20 | 5.83% |

| 1999 | $16.69 | 6.00% |

| 2000 | $16.27 | 5.85% |

| 2001 | $15.74 | 5.66% |

| 2002 | $16.08 | 5.79% |

| 2003 | $17.39 | 6.26% |

| 2004 | $19.44 | 7.00% |

Suppose an investor bought one share of the S&P index at 277.78 in 1988. This investment yielded

3.50% at the time of purchase. Now, in 1989 this stock produced $11.05 in income. The yield in 1989 was

3.97%. After 15 years, in 2004 the same stock produced an income of $19.44. The yield in 2004 was

7.00%.

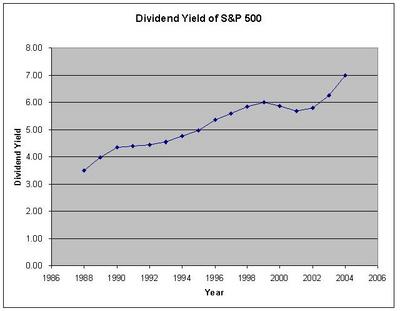

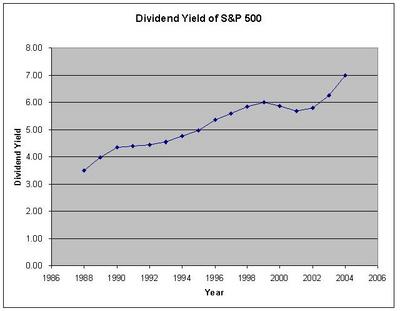

Following chart displays the year and dividend yield of the S&P 500.

Even though the current dividend yield is tiny 1.79%, the investors who bought into S&P 500 index fund in 1988 are enjoying 7% dividend yield right now.

Data Source:

S&P 500 Earnings & Estimate Report